Figuring out how much you need to save for retirement is a very common question. There isn’t a one-size-fits-all answer. It depends on your overhead for bills, how much you can set aside for saving, and the kind of lifestyle you want to have when you’re retired. In the video below, Massi De Santis, PhD explains saving for retirement and the outcome for different savings models.

Video Transcript

The number one thing people need to do for retirement is to save, but how much should you save? One rule of thumb is to contribute enough to get the maximum match in your 401k. Or you might have heard that saving 10% of your salary is a good rule.

10% savings rule

In our research, we tested this rule of 10% of your income on two hypothetical workers. Jack and Jill.

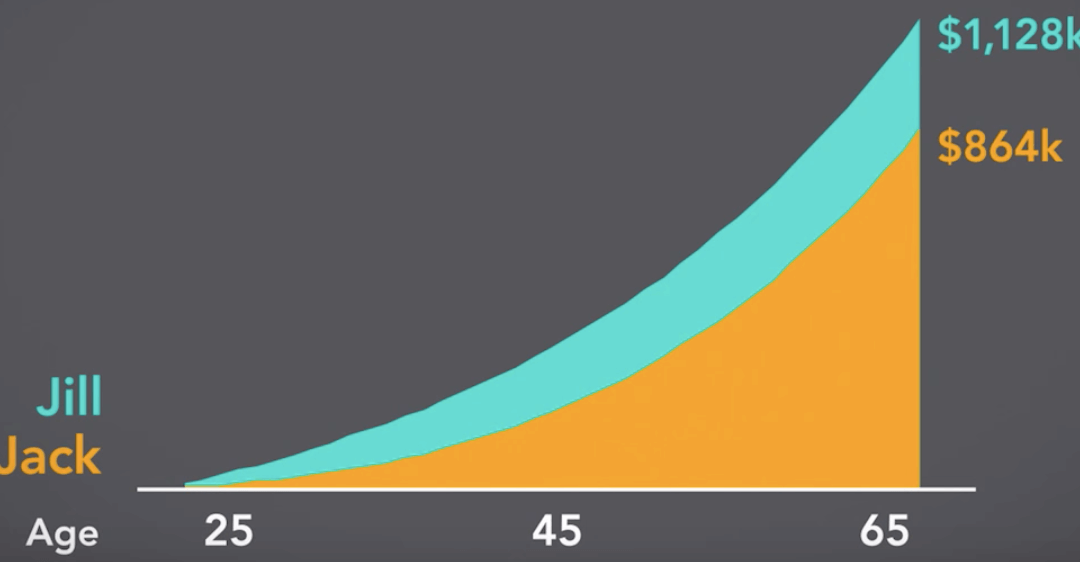

Jill’s income stays the same throughout her career. She earns a $100,000 income for 40 years. Jack starts at a much lower wage: $20,000 but with regular raises, he ends up earning $180,000 just before retirement.

Jack and Jill have some things in common. They’re both saving 10% of their income every year and they have the same annual investment returns.

In this example, Jill saves more earlier in her career because her income is higher and because her money has longer to grow, she ends up with a larger amount of wealth than Jack.

What does that mean for their retirement? Jill’s nest egg can replace 51% of her pre-retirement income. Jack’s on the other hand replaces about 22%. Jack has a larger pre-retirement income and his savings doesn’t go far enough to replace his standard of living.

Our research shows that how much your income grows over your entire career plays an important role in how much you should be saving for retirement.

Saving more as income increases

Let’s go back to Jack with a new retirement goal. This time, let’s find out how he can replace 40% of his pre-retirement income. In our new model, Jack starts out saving about 5% of his income, but as Jack’s income rises, so does the percentage he saves. At $100,000, his saving rate is 15% including employer contributions.

By the time Jack reaches retirement, higher saving rates mean he’s on target to reach his goals. Overall, there are a few benefits from this dynamic approach to saving for retirement. First, because saving rates start out low, this should make the idea of saving for retirement more manageable.

Second, saving rates grow gradually. This way saving can be increased as you get raises. This might be easier because you won’t be cutting back just saving more. Whether your income looks like Jack’s or Jill’s, the key part to this dynamic approach are saving consistently; Saving more as your income grows and monitoring progress towards your goal.

Which savings model is best for you?

Give us a call and let us help you optimize your retirement saving’s goals.