Timely resources for maintaining a long-term perspective in tumultuous times

It’s not easy to stay calm amidst the fear and panic of a sharp market correction. Financial planning helps our clients stay calm and avoid emotional decisions. We develop personalized Investment Policy Statements for our clients. Each client’s asset allocation is designed to withstand volatility and turmoil and to address short-term financial needs so that the long-term plan stays on track throughout their financial plan. Recent volatility falls within these long-term expectations. As we have during past market shocks, we will continue to monitor the situation closely and add updates and links on this page as the news evolves.

Helpful Resources and Articles:

- Stock Market Declines Can Help Long-Term Investors

- Perspective in a Time of Heightened Volatility

- How Do Higher Interest Rates Bring Down Inflation?

- Fed’s Message: Get Ready

- How to Handle Market Declines

- When You Think About Investing, Don’t Think About the News

- Missing the Market’s Best Days

- NYT Opinion: We Have Never Been Here Before (Russia/Ukraine)

- How to Invest Calmly in a Chaotic World

- 4 Historical Maps that Explain the USSR

- How to Survive When Stocks Behave Badly

- The Psychological Pitfalls of a Market Cycle

- Suffering Through Your First Financial Crisis?

- How to Stop Worrying and Love a Falling Stock Market

- Investing Against the Tide

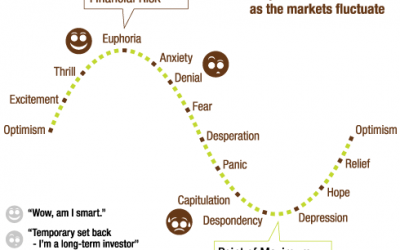

Understand the Cycle of Market Emotions to Make Better Financial and Investment Decisions

Don’t let emotions get the best of you. Understanding the cycle of market emotions can help investors make better financial and investment decisions.

Why We Must Stick to a Financial Plan When Markets are Volatile

Market volatility happens. Do you let fear take the wheel? Learn why the best thing you can do is stick to a financial plan in a volatile market.

How to Prepare and Survive a Market Decline

Market declines can worry people and people often wonder if they will survive them.

How to Choose a Financial Planner That’s Right for You

Learn about the different types of financial planners along with the right questions to ask.

How to Find a Financial Advisor You Can Trust

The right financial advisor can add up to 3.75% of value to your profile. Find the right advisor that will serve your long-term interests.