SOURCE: SEEKING ALPHA

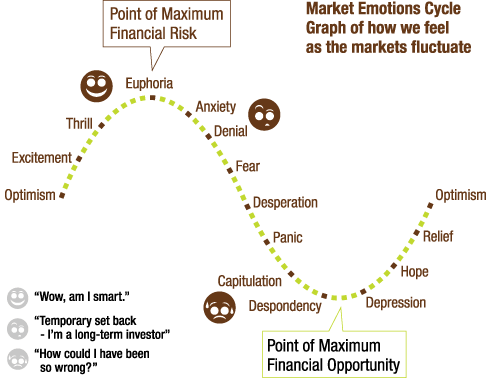

The cycle of market emotions evolve as the market fluctuates. The two primary emotions of investors are fear and greed. After nearly 11 years of economic expansion, and emotions fluctuating between the points of Optimism, Excitement, Thrill, Euphoria and Anxiety on the Emotions of Investors chart, the turmoil caused by the COVID-19 pandemic has shifted the primary emotions onto the slope of Fear, Desperation and Panic, and is sliding through Capitulation.

Being aware of emotions is a key trait of successful savers and investors. The temptation of falling into one of these emotional traps is to make sure you’re committing to a well-defined, long-term investment plan.

It’s not easy to stay calm amidst fear and panic. A well-designed Investment Policy Statement and Asset Allocation are designed to withstand volatility and turmoil and to address short-term financial needs so that the long-term plan stays on track throughout each client’s financial plan. Recent volatility falls within these long-term expectations. Awareness about how emotions affect investment decisions can help investors avoid emotional decisions and stick with their long-term financial plan.