There was so much hype for 2020. A promise of parties and prosperity like those highlighted in F. Scott’s Fitzgerald’s, The Great Gatsby. The novel coronavirus, COVID-19, changed those expectations for everyone around the world. With this abrupt change to economic conditions, The Federal Reserve and Congress stepped in with both monetary and fiscal stimulus to provide liquidity for those most in need.

The CARES Act, which stands for “Coronavirus Aid, Relief, and Economic Security Act,” was introduced by the Senate on March 19th, 2020 to help bolster the economy and support those citizens most affected by the virus. There are many provisions in this bill, but one in particular offers coronavirus student loan relief to borrowers’ financial stress and hardship caused by the COVID-19 pandemic. Applied retroactively to March 19th, it mandates student loan servicers to adjust interest on these loans to 0% through September 30th, 2020. This means that any payments made toward these loans will either be made as an advance payment or go directly to principal. If any payments are made to a loan provider over this period, it is recommended that the borrower specify their desired payment type.

Student Loan Borrowers and Income Levels

Borrowers concerned about their income levels on or after September 30th may consider advancing their payments to provide a cushion for themselves once the interest rates return to “pre-crisis” percentages and payments resume. Borrowers who feel comfortable with their income levels in the near future should consider making a principal payment toward their loan. Lower loan balance means less of your payment is going to your lenders.

Paying Down Debt

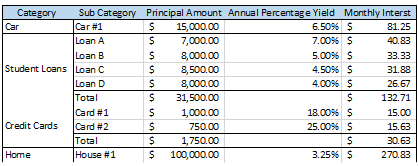

A third option borrowers could consider is to take the money that would otherwise go toward their loan and apply it to another debt, savings, or investment account. A common school of thought is to have three-to-six months of expenses set aside in emergency reserves at all times, and this is an excellent time to use this interest-free period to set this up. Borrowers focused on paying down debt might choose to make a table like the one shown below. In this example, money is directed where it is most beneficial from student loans to the credit card with the highest interest rate, to decrease the total monthly interest payment. Borrowers with a longer-term time horizon might choose to invest their payments in riskier assets, like stocks, to attempt to earn a return higher than the rate they’re paying on their debt.

There is no “right” way to leverage this opportunity. Everyone has unique needs based on their individual situations. Now is an excellent time for borrowers and investors to take a step back to acknowledge any changes to their financial position and redefine personal goals. Then, apply funds thoughtfully. Borrower and investor should consult their financial planner to discuss the viability of their plans and possible tax advantaged savings strategies.