Yields on bonds have fallen in recent years and have remained low for some time. What is one to do that is accustomed to receiving interest through bank accounts, certificates of deposits (CDs) or bonds? Income-seeking investors have started searching for income-producing alternatives. This trend has influenced many investors to take on riskier investments to replace today’s disappointing bond market yields and it has also even encouraged savers to consider alternatives in an attempt to replace the interest they may have received in years prior. One of those alternatives is high-yielding dividend paying stocks.

What is a bond yield?

“A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of the bond, and current yield which equals annual earnings of the bond divided by its current market price. Additionally, required yield refers to the amount of yield a bond issuer must offer to attract investors.” According to Investopedia.

Let’s examine a real company that has managed the dividend appropriately we’ll call it Company A.

With a current yield of 2.74%, it appears attractive in today’s market. An income-hungry and well versed investor notes that the yield has increased over the last four years. So what does this mean?

How are yields calculated?

Yield is calculated using the per-share annual dividend and the stock price of a company. Therefore, a stock’s “yield” is heavily dependent on both these factors, and both must be considered when evaluating the investment opportunity.

Below is a chart showing Company A’s stock price compared to its dividend yield and dividend price from 2015 – 2019.

We see that the price of the stock and the dividend yield move conversely. In the above chart, we see the historical growth of Company As dividends. Between 2015 and 2019, the payout increased from 12 cents to 20 cents per share. But the dividend yield has remained relatively flat.

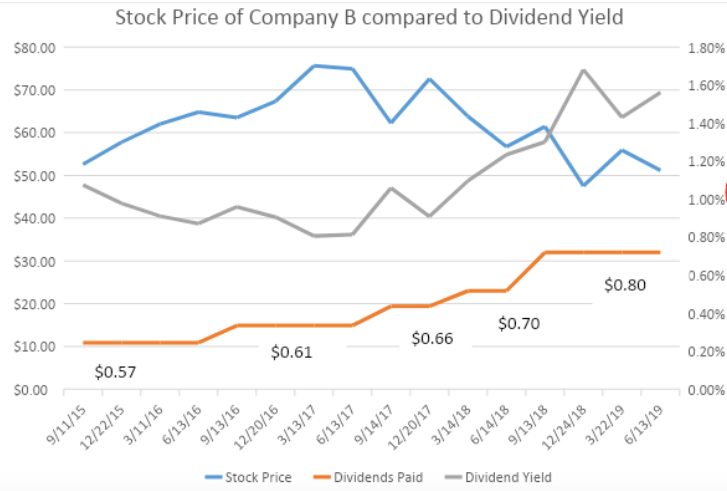

Now let’s examine Company B.

The chart also shows that, since 2012, both the dividend and the stock price have remained stagnant. This stagnation and the weakness of the stock price should cause an investor to dig deeper into the financial strength of the company before investing. Investing in a stock solely to get the advantage of the dividend can be dangerous. It is important to understand that you will also be invested in the equity of the company. A review of the financial statements should provide information about whether the company can afford to continue the dividend payout and if corporate performance is on the right track.

The bottom line when screening for high yield

When screening for high yield, don’t stop at yield; strive to understand why it’s high!

Reaching for yield in dividend paying stocks can be an enticing alternative for income. However, a dramatic decrease in a stock’s price may result in an inflated yield and misrepresentation of a good investment. Further analysis to determine if the company’s cash flow is under pressure or distressed may make a difference in the investment decision. Taking the time to evaluate these factors is worthwhile before deciding whether to place a trade.